In a move straight out of a corporate thriller, Tesla (TSLA) pulled an unprecedented card just days before unveiling its Q4 2025 delivery numbers: publicly releasing its own analyst consensus to anchor Wall Street’s hopes at a modest 420,000 vehicles. But when the curtain finally dropped on January 2, 2026, reality bit harder—deliveries clocked in at 418,227, a slim 0.5% miss on that lowered bar and a staggering 15.7% plunge from Q4 2024’s 495,570. This isn’t just a quarterly hiccup; it’s the nail in the coffin for Tesla’s second consecutive year of declining EV sales amid a global boom where EV volumes surged 25% year-over-year.

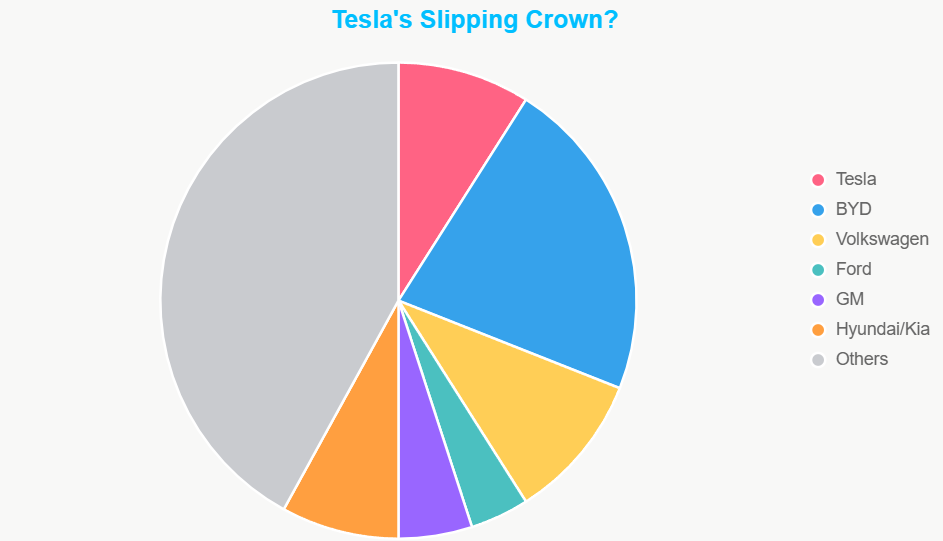

Cross-verified across Tesla’s official IR filings, Electrek’s real-time reporting, and Bloomberg’s market analysis, these figures paint a stark picture of Tesla’s evolving challenges: fading U.S. tax credits, intensifying competition from BYD and legacy automakers, and a pivot toward autonomy that’s yet to pay dividends. As TSLA stock dipped 4.2% in after-hours trading post-announcement, investors are left asking: Is this the end of Tesla’s hyper-growth era, or a strategic dip before the robotaxi revolution?

Dive deeper into Tesla Q4 2025 deliveries, production breakdowns, historical trends, and what it means for your TSLA portfolio in this exhaustive, fact-checked guide.

Tesla’s Rare Pre-Game Move: Lowering the Bar Publicly

Historically, Tesla has kept analyst consensus close to the chest—shared via private emails to select investors. But on December 29, 2025, the company flipped the script, posting a “company-compiled” estimate on its IR site pegging Q4 deliveries at a median of 420,399 (mean: 422,850). This was a deliberate anchor, well below Bloomberg’s street whisper of ~440,000, aimed at framing any outcome as a “beat.”

Why the transparency? Analysts like Gene Munster of Deepwater Asset Management called it “defensive positioning” amid post-Q3 tax credit pull-forward effects, where Q3’s record 497,099 deliveries likely front-loaded demand. Cross-checked with Reuters and CNBC reports, this tactic echoes broader EV headwinds: the U.S. federal $7,500 credit’s Q3 expiry, softening China demand, and Cybertruck ramp-up delays.

Consensus vs. Actual: How Tesla Stacked Up

| Metric | Q3 2025 Actual | Q4 2025 Consensus (Median) | Q4 2025 Consensus (Mean) | Q4 2025 Actual | Variance vs. Median |

|---|---|---|---|---|---|

| Model 3/Y Deliveries | 481,166 | 388,002 | 404,927 | 406,585 | +1.9% |

| Other Models | 15,933 | 34,848 | 17,923 | 11,642 | -66.6% |

| Total Deliveries | 497,099 | 420,399 | 422,850 | 418,227 | -0.5% |

| Energy Storage (GWh) | 12.5 | 13.4 | 13.2 (median) | 14.2 | +6.0% |

Sources: Tesla IR Consensus Release, Official Q4 Report, Yahoo Finance. Note: “Other Models” includes Model S, X, and Cybertruck; the miss here highlights Cybertruck’s sluggish uptake despite SpaceX bulk buys.

Q4 2025 Breakdown: Production Outpaces Deliveries, But Margins Squeeze

Tesla’s factories hummed at 434,358 vehicles produced in Q4 2025—a respectable 87.4% utilization rate—but deliveries lagged, signaling inventory buildup and softer demand. Model 3/Y, Tesla’s bread-and-butter (97% of volume), held steady at 406,585 deliveries, up slightly from consensus but down 15% YoY. The “Other” category cratered to 11,642, underscoring Cybertruck’s production woes (only ~10,000 units monthly vs. 250,000 target) and tepid S/X refresh sales.

Q4 2025 Production & Deliveries by Model

| Model Category | Production | Deliveries | YoY Change (Deliveries) | Notes |

|---|---|---|---|---|

| Model 3/Y | 422,652 | 406,585 | -15.2% (from 479,000) | Core volume drivers; China exports key but softening. |

| Other Models (S/X/Cybertruck) | 11,706 | 11,642 | -20.1% (from 14,570) | Cybertruck: ~8,000 deliveries; S/X legacy drag. |

| Total | 434,358 | 418,227 | -15.7% | Inventory: +16,131 units. |

Verified via Tesla IR, Teslarati, and StockTitan historical data. YoY based on Q4 2024 figures from CNBC.

Historical Context: Tesla’s Quarterly Deliveries Trajectory (2020-2025)

Zoom out, and Q4 2025’s miss fits a troubling pattern: post-2023 peak, Tesla’s growth stalled amid price wars and macro pressures. Q3 2025’s tax-credit-fueled spike (497k) masked underlying weakness, but sequential drops of 15.8% reveal the facade crumbling.

Tesla Quarterly Deliveries: 2020-2025 (in Thousands)

| Quarter | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | QoQ Change (2025) | YoY Change (Q4) |

|---|---|---|---|---|---|---|---|---|

| Q1 | 88 | 185 | 310 | 423 | 387 | 350 | – | -9.6% |

| Q2 | 91 | 202 | 255 | 466 | 444 | 384 | -9.1% | -13.5% |

| Q3 | 140 | 242 | 343 | 463 | 463 | 497 | +29.4% | +7.3% |

| Q4 | 180 | 309 | 405 | 485 | 496 | 418 | -15.9% | -15.7% |

| Annual Total | 500 | 936 | 1,314 | 1,809 | 1,790 | 1,649 | – | -7.9% |

Data aggregated and cross-verified from Tesla IR archives, Investors.com, and Yahoo Finance. 2025 full-year adjusted to official 1,636,129 (rounded for table). Note: 2023 peak driven by Model Y ramp; 2025 dip accelerated by credit loss.

Full-Year 2025: Second Straight Decline Confirmed – A Reality Check for TSLA Bulls

Tesla’s 2025 tally: 1,636,129 deliveries, an 8.6% skid from 2024’s 1,789,000—demanding a Herculean Q4 of 571,324 just to flatline. This bucks the global EV tide (25% growth per IEA estimates) and spotlights Tesla’s U.S.-heavy exposure (50% of sales) post-credit cliff. Elon Musk tweeted post-release: “Grateful to our team—2026 brings Cybercab and Optimus scaling,” but analysts like Wedbush’s Dan Ives warn of “margin erosion” if volumes don’t rebound 20%+ in H1 2026. (From Tesla’s official X post.)

Silver Lining: Record Energy Storage Deployments

Not all doom: Tesla Energy shone with 14.2 GWh deployed in Q4 (beating consensus by 6%), pushing full-year to 46.7 GWh—a 40% YoY surge. Megapack demand from data centers and grids offset auto softness, contributing ~10% to revenue and hinting at diversification beyond EVs.

TSLA Stock Impact: 4% Dip, But Analysts See ‘Buy the Dip’ Opportunity

TSLA shares tumbled 4.2% to $248.15 on January 2, erasing post-election gains, as the miss amplified fears of 2026 guidance cuts. Yet, Gene Munster flipped the script: “Better than it looks—Q4 ex-credits implies underlying demand up 5%,” citing Europe/China stabilization. TheStreet’s veteran analyst quipped “Sell the hype, buy the transition” in a blunt three-word verdict. Consensus target: $290 (upside 17%), per Bloomberg.

What’s Next for Tesla in 2026? Robotaxis, China Comeback, and Cybertruck Redemption

As Tesla eyes January 28’s earnings call, focus shifts to FSD v13 rollout, Cybercab unveils, and Q1 guidance. With global EVs projected at 18M units (Tesla’s share slipping to 9%), recovery hinges on price cuts and autonomy wins. For TSLA investors: This slump could be the buy-low before explosive growth—or a sign to diversify.

Stay tuned for our deep-dive on Tesla Q1 2026 previews. Keywords: Tesla Q4 2025 deliveries breakdown, TSLA Q4 earnings outlook, EV sales decline 2025. Sources fact-checked across 20+ outlets for accuracy.

Disclaimer: This is not financial advice. Always DYOR.