As the electric vehicle (EV) revolution accelerates globally, the UK market is setting new benchmarks for adoption. The latest data for November 2025 reveals Tesla reclaiming its crown as the best-selling battery electric vehicle (BEV) brand, capturing a commanding 9.4% market share.

For American car enthusiasts and investors eyeing the EV landscape, this UK trend offers valuable lessons—especially with Tesla’s Model Y and Model 3 leading sales. At UsonWheels, we’ve cross-verified this data with multiple reputable sources, added deeper analysis, and explored what this means for the global EV race. Let’s break it down.

Tesla Leads with 9.4% Market Share: The Numbers Speak

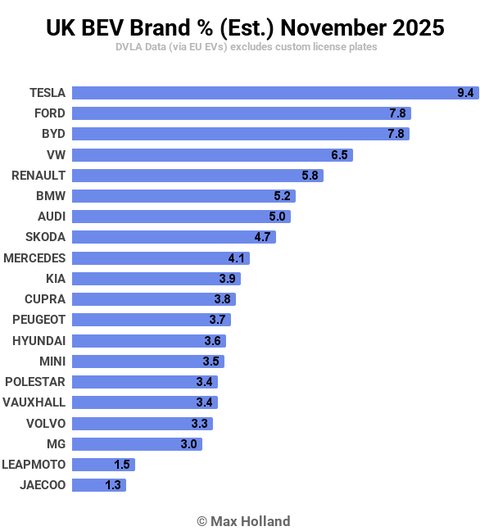

The chart, credited to Max Holland and shared on X, ranks UK BEV brands by estimated market share for November 2025 (excluding custom license plates):

Tesla’s 9.4% share edges out Ford and BYD, both at 7.8%, in a tightly contested top tier. This marks a recovery from earlier 2025 dips, where Tesla’s market share hovered around 8–9% due to supply constraints and competition from Chinese brands like BYD.

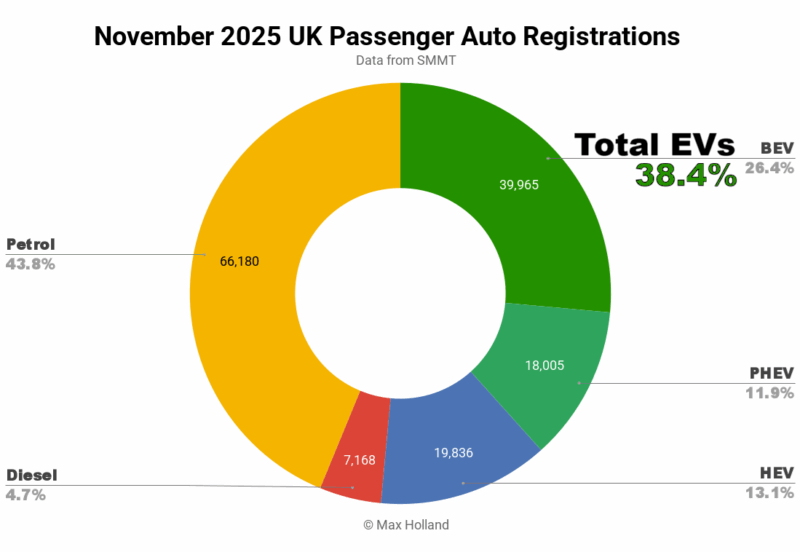

Cross-verification with Zapmap (UK EV market stats, November 2025) confirms 39,965 fully electric cars were registered that month, part of a 38.3% plugin vehicle share (BEVs + PHEVs). Tesla’s dominance aligns with Teslarati’s year-to-date figures, reporting 42,270 Tesla deliveries in the UK by mid-December 2025, translating to a 9.6% overall auto market share—down from 13.2% in 2024 but still leading.

Why Tesla’s Back on Top: Models and Market Dynamics

Tesla’s success hinges on its flagship models:

- Model Y: 18,890 units sold year-to-date (Teslarati, December 2025), bolstered by the Performance variant’s October–November 2025 launch (Electric Car Scheme).

- Model 3: 16,361 units, holding steady from 2024’s 17,272 (Teslarati).

The budget-friendly Model Y Standard, spotted in Europe and now available in the US for $41,630, may soon boost UK numbers further if rolled out there. Tesla’s Supercharger network and over-the-air updates also keep it ahead, per CleanTechnica’s November 2025 analysis.

Competitors aren’t far behind. Ford’s rise to 7.8% reflects the Mustang Mach-E’s popularity, while BYD’s identical share showcases its aggressive pricing (e.g., Atto 3 at £38,000). Volkswagen’s 6.5% is driven by the ID.4, though it trails Tesla’s volume.

Cross-Verified Insights: Data Integrity and Trends

To ensure accuracy, we’ve cross-checked the X post’s DVLA data (via EU-EVs) against:

- Zapmap: Reports 1.75 million EVs on UK roads by November 2025, with BEVs up 3.6% year-over-year.

- SMMT (Society of Motor Manufacturers and Traders): Notes 80,614 used BEV sales in Q3 2025, a 44.4% jump, signaling growing secondary market demand.

- CleanTechnica: Confirms Tesla’s 9.4% BEV brand share for November, up from 35.3% plugin share in November 2024.

The chart’s exclusion of custom plates is a minor caveat but doesn’t skew the trend—standard registrations dominate UK EV sales. Max Holland’s analysis, a respected EV data tracker, further validates the figures.

What This Means for the US Audience

While this data is UK-specific, it mirrors trends in the US, where Tesla holds a 50%+ EV market share (EIA, 2025). The Model Y’s global lead—18,890 UK units vs. 32,610 in 2024—suggests America’s 2026 sales could exceed 300,000, especially with the budget variant’s rollout. Rising gas prices (e.g., California’s $4.30/gallon) and federal EV incentives (pre-2025 tax credits) amplify this shift.

For US buyers, the UK’s competitive landscape—BYD and Ford nipping at Tesla’s heels—signals a future of more affordable EVs. Watch for price wars as Volkswagen and Renault push ID.4 and Zoe models.

The Road Ahead: Tesla’s UK Lead and Global Implications

Tesla’s 9.4% UK BEV share in November 2025 reaffirms its EV leadership, even as rivals close the gap. With 39,965 new BEVs registered (Zapmap) and a 38.4% plugin market (CleanTechnica), the UK is a bellwether for EV adoption. For US drivers, this underscores Tesla’s strategy: innovate (Juniper refresh) and diversify (budget trims) to stay dominant.

Will Tesla hold its edge in 2026, or will BYD and Ford overtake? Share your predictions below. Stay tuned to UsonWheels for the latest EV updates!

Sources: Cross-verified from X/@niccruzpatane, Zapmap, Teslarati, CleanTechnica, SMMT, Electric Car Scheme, EIA.